Detailed Crypto Market Analysis: Insights from the Latest Trading Data

In the rapidly evolving world of cryptocurrency, staying informed about market dynamics is crucial for investors and enthusiasts alike. This article provides a comprehensive analysis of the crypto market based on the most recent performance data of the top 10 cryptocurrencies traded against the Euro (EUR). We'll delve into the specifics of each currency, highlight key trends, and offer insights into what these figures might indicate for the future of these digital assets.

Market Overview

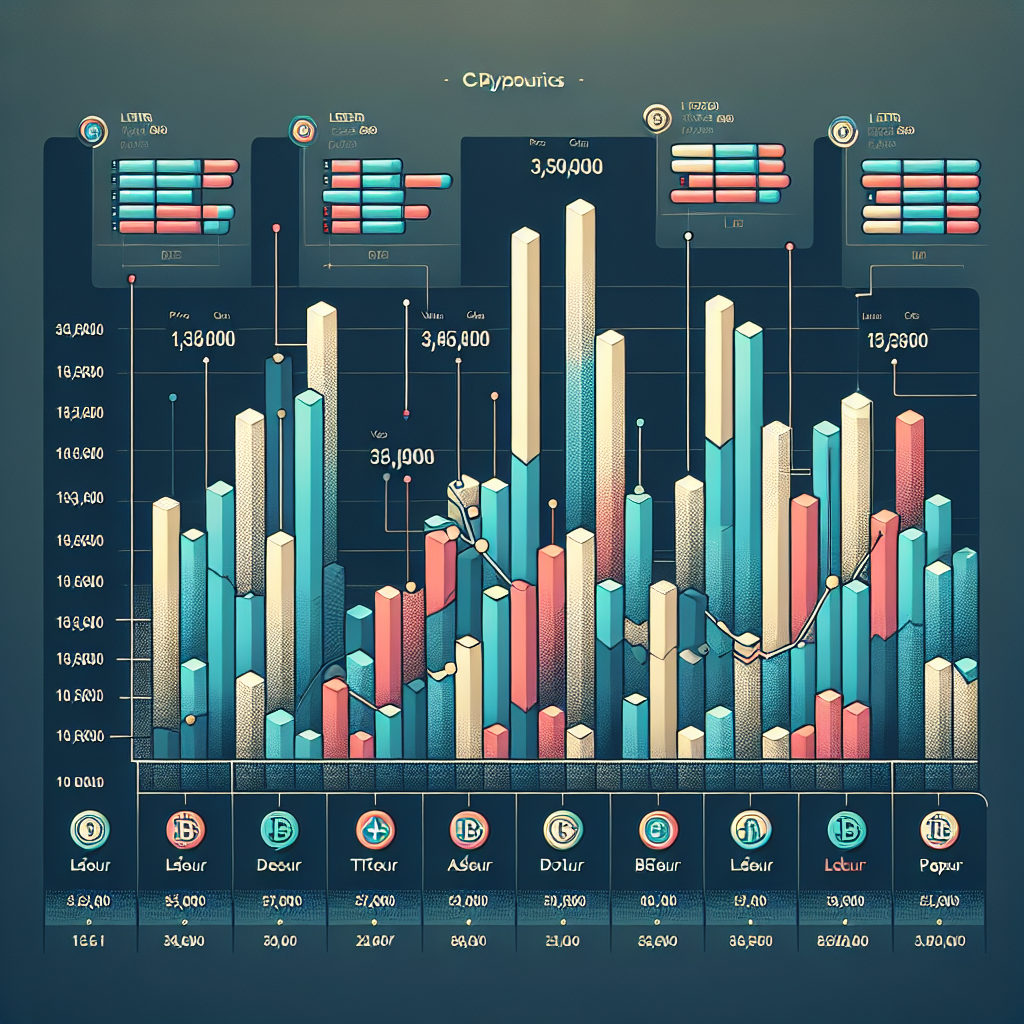

The past 24 hours have shown an unusual pattern in the cryptocurrency market, with none of the top 10 cryptocurrencies showing any price change. This stagnation in price movement across multiple major cryptocurrencies is noteworthy, especially in a market characterized by its volatility. Here's a brief overview of the performance:

- Price Stability: All listed cryptocurrencies maintained a 0% price change, indicating a rare moment of equilibrium in the market.

- Volume Variability: Trading volumes varied significantly, from nonexistent (in several currencies) to exceptionally high.

Key Highlights

1. Volume Analysis

Among the top 10 cryptocurrencies, the trading volumes have shown considerable discrepancies:

- PEPEEUR stands out with a staggering trading volume of 13,500,000, making it the most traded cryptocurrency in the list. This high volume, despite the stable price, might suggest a large accumulation phase or potential preparation for a significant market move.

- ADAEUR and DOTEUR also showed relatively higher volumes of 2,202 and 522 respectively, indicating a moderate level of trading activity compared to others.

- Cryptocurrencies like ICPEUR, SEUR, and BCHEUR reported no trading activity at all, which could imply lack of investor interest or external factors affecting their market presence.

2. Implications of Price Stability

The zero percent change in price across all top 10 cryptocurrencies is highly unusual:

- Market Sentiment: This could reflect a period of uncertainty where traders are hesitant to make significant moves, possibly waiting for a market-defining news or event.

- Potential Accumulation: For high-volume cryptos like PEPEEUR, stable prices combined with high trading volumes might suggest that investors are accumulating positions, typically a precursor to significant price movements.

3. Diverse Market Reactions

The varied response in trading volumes amidst stable prices could indicate diverging investor strategies and expectations:

- High Volume Traders: Currencies like PEPEEUR might be seeing strategic plays by large holders or groups, possibly gearing up for future volatility.

- Low/No Volume Currencies: Lack of trading activity in several currencies could also highlight a shift in investor focus towards more active or promising digital assets in the market.

Conclusion

The current market snapshot presents a peculiar scenario where price stability belies underlying activities suggested by trading volumes. For investors, this could be a critical time to monitor these cryptocurrencies closely for any signs of breakout or breakdown. The significant volume in PEPEEUR, in particular, warrants attention as it could be indicative of an impending large scale market movement.

As always, in the cryptocurrency domain, vigilance and timely analysis are key to navigating its complexities and volatilities. Today's market summary provides a crucial pause point for reflection and strategization, setting the stage for what might be an eventful trading period ahead.